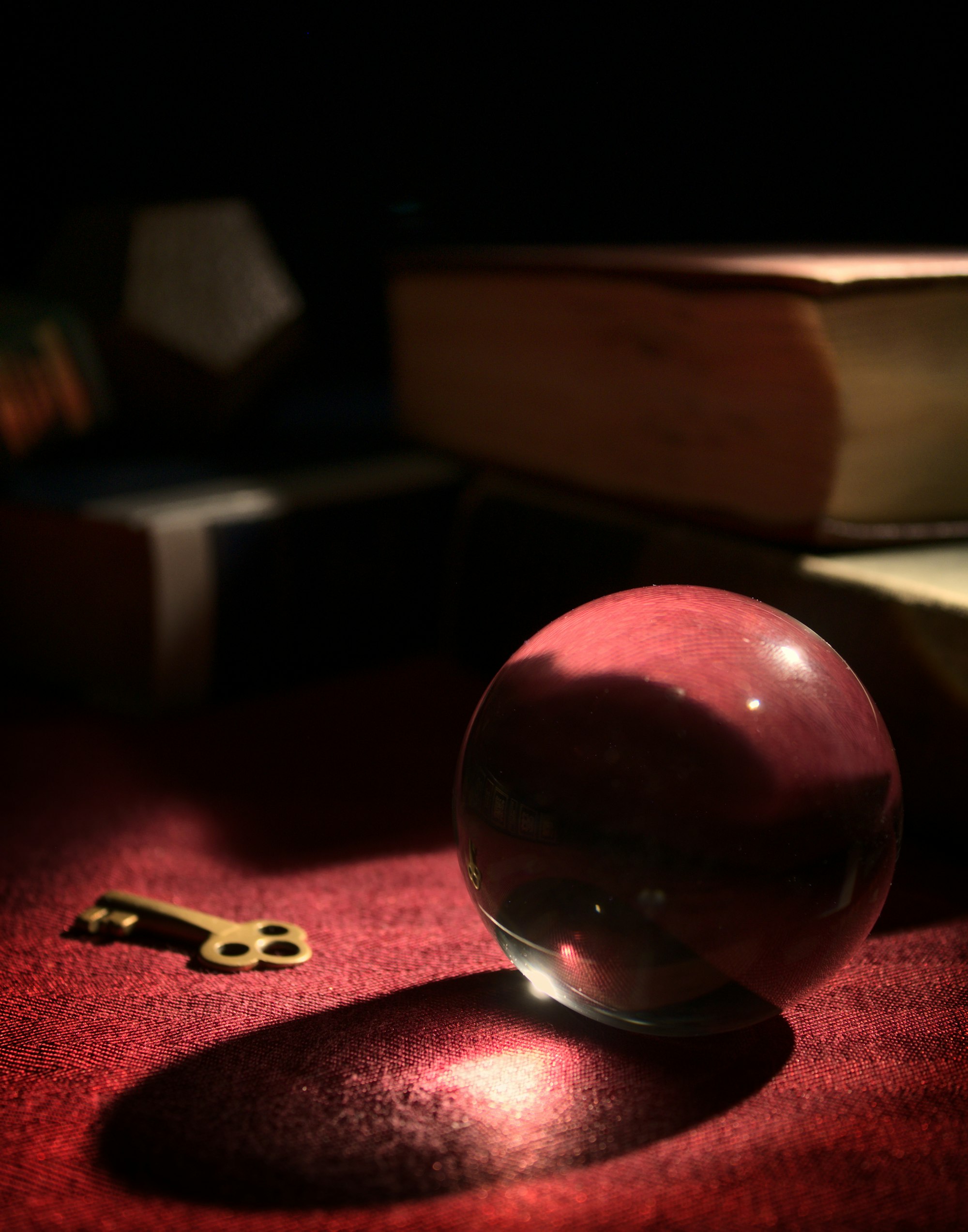

For a few dollars, you can ask a fortune teller to peer into her crystal ball and reveal your future. For a few hundred billion dollars, you can soon ask the secretary of education to do the same.

Ever since the Supreme Court invalidated the Biden administration’s plan to forgive $430 billion worth of student debt, the U.S. Department of Education (ED) has been on the hunt for a legal workaround to enact a similar policy through different means. So far, ED’s preferred strategy is to propose cancelling debt for borrowers who meet certain criteria, but define these criteria so broadly that millions of borrowers qualify. Framing loan cancellation as a targeted rather than universal policy might help it pass legal muster—or so officials hope.

But ED’s latest proposal adds a new twist. Rather than cancelling debt for borrowers who meet certain criteria, the Biden administration is now floating a plan to cancel debt for borrowers whom the secretary of education guesses will meet certain criteria in the near future.

Draft regulatory text released last week would allow the secretary to fully cancel the loans of borrowers “who the secretary determines … are at least 80 percent likely to be in default [on their federal student loans] in the next two years.”

How would the secretary make this determination? He would be allowed to consider no fewer than 17 factors that signal “hardship” on the part of the borrower, including: household income, other consumer debts, whether the borrower received a Pell Grant, whether the borrower finished college, spending on other expenses, and a catchall category for “other indicators of hardship identified by the secretary.”

In other words, if a borrower’s circumstances signal to the secretary that she is likely to default in the next two years, the secretary would be allowed to cancel her loans in full.

Making student loan policy by crystal ball presents a number of problems. The model that the secretary would use to determine likelihood of default is not specified in the regulation; such a black box is vulnerable to manipulation until the ED achieves its desired outcome. Moreover, if the secretary cancels the debts of all borrowers whom he determines are likely to default, there is no way to test the reliability of the model going forward, since borrowers cannot default on loans that have been cancelled.

The likeliest outcome is that ED will look into its crystal ball and declare that tens of millions of borrowers are at risk of default, and therefore tens of millions of borrowers must have their debts cancelled. As I noted in a previous post, just two of the conditions that qualify as “hardship” on ED’s list (receiving a Pell Grant and failing to complete a degree) cover 71 percent of former college students—meaning the “hardship” standard could trigger loan forgiveness for the vast majority of borrowers.

By the standards of fiscal responsibility, the crystal ball approach to loan cancellation could be worse than the one-time loan forgiveness plan which the Supreme Court struck down. That plan would have capped cancellation per borrower at $20,000, whereas the new proposal allows the secretary to cancel borrowers’ debts in full. The new proposal also empowers the secretary to cancel debts on an ongoing basis—meaning future students would see forgiveness alongside current borrowers—while the old plan was theoretically a one-off.

With budget deficits already at $1.4 trillion, America cannot afford several hundred billion dollars of student loan cancellation. The Biden administration should instead work with Congress to pass targeted relief for student loan borrowers experiencing real financial distress, and pay for it by reining in subsidies for colleges that leave students unable to repay their debts. Such responsible reforms to the loan system will be better for students and the nation’s fiscal health in the long run—even if they don’t grab the same headlines as policymaking by crystal ball.